John Waupsh was attending college in Chicago in 1997, when he decided to turn his love for funk and soul music into his own DJ business. While he was just looking for a way to pay some of his tuition bills, he wanted to keep his business finances separate from his personal finances, to present more professionally to his clients. When he landed his first paying gig, he walked into a local bank branch to open up a business checking account. The bank teller took one look at his business situation, laughed, and promptly told him to leave.

“I remember crossing the street, so irate and embarrassed,” says Waupsh. “It was as if I had asked for a $100,000 loan as a college kid. That scene in my mind has probably replayed itself subconsciously for the last couple of decades.”

Flash forward those couple of decades, and Waupsh become a leader at the financial services company Kasasa, an author, and the owner of a record label, The Preservation Project. Although that bank in Chicago instilled in Waupsh a resolve to manage his money more effectively, he still ran into the same problems that he did as a young DJ.

“I don’t understand why on earth it is still so hard for me to get a business checking account for a company, or for a startup, or for myself,” he says. “There’s a lot of fire to fix that problem so I figured, ‘let’s do it first where the most passion is—the music space.’”

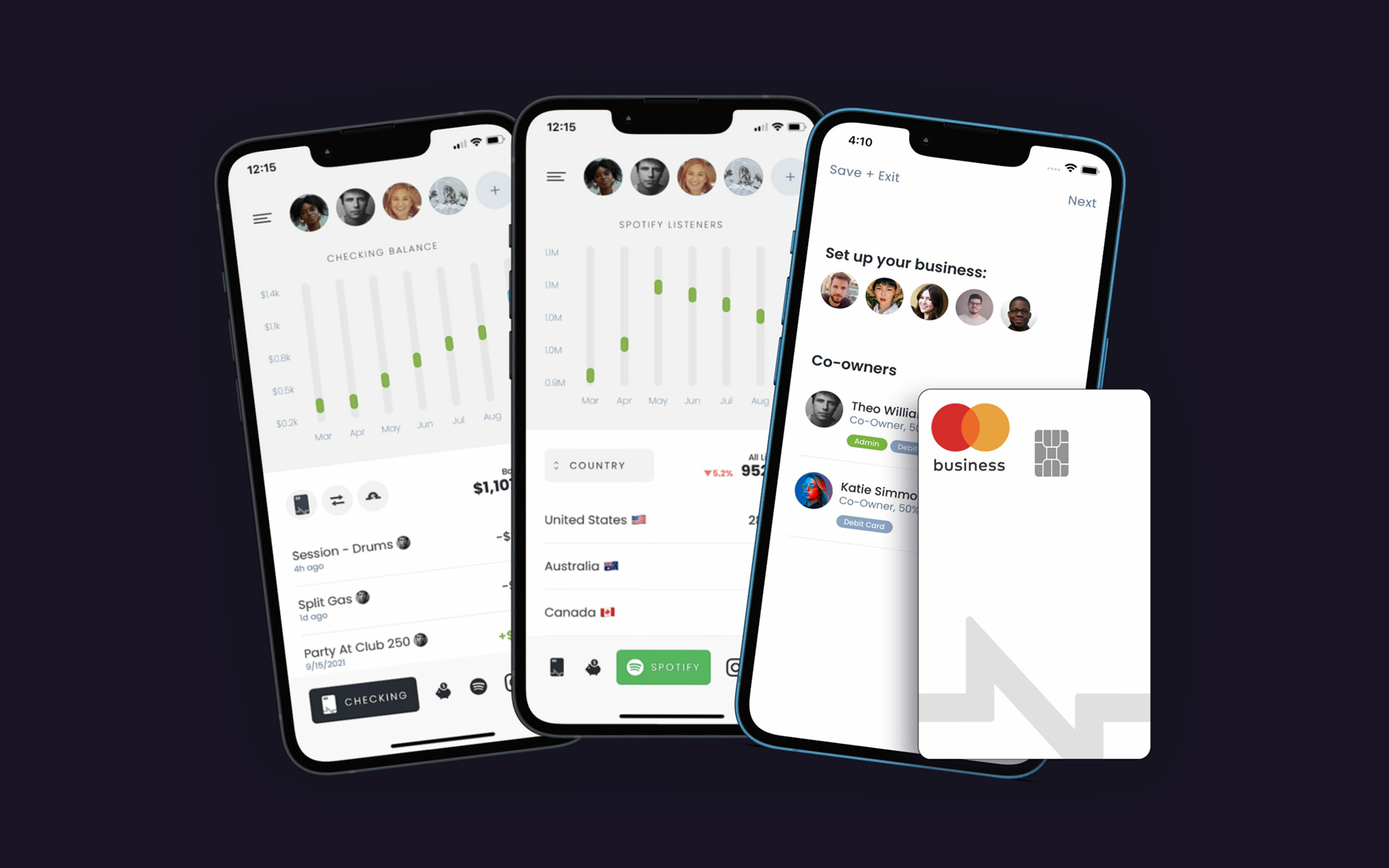

Waupsh teamed up with fintech engineer and Kasasa colleague, Ben Morrison, to create the world’s first musician-focused online banking app, Nerve. It’s free, it’s FDIC-insured through Piermont Bank, and it only takes about a minute to open an account. You simply download the app, fill in your name, address, and social security number, hit accept, and you’re in—next thing you know a sleek white debit card is on its way to your mailbox.

Waupsh and Morrison approached Berklee Online instructor Benji Rogers, who is the co-founder of the digital strategy consultancy Lark 42, for his expertise in scaling music technology. Rogers, who is interested in business ideas that empower musicians and enhance the fan experience, was on board almost immediately.

TAKE A BERKLEE ONLINE COURSE WITH BENJI ROGERS

“There’s plenty of rejection in the music industry already—you don’t need it from your bank as well,” says Rogers. “The minimum to open a business checking account is huge for people starting out. Your skin thickens, the more you’re told no, but it doesn’t mean that you’re not a business, and it doesn’t mean that you don’t have the same needs as a business.”

Read: How to Turn Your Band Into a Business

To this point, Nerve allows musicians to run their music project like a business and prevents entangling personal finances with professional finances. Because Nerve keeps a running tab of all the expenses that are going in and out of a creative project, it’s easy to refer back to that documentation, whether it’s for claiming business expenses on your taxes or proving your income to a lender.

“If you’re going to be a business, you need to bank like a business, otherwise you are going to be perpetually experiencing the downsides,” says Rogers. “As someone who’s looked at a lot of technology, the way that John and his team designed this is with this exact use in mind, and you will not get that from anywhere else.”

While there are now more business checking accounts with a lower barrier to entry than there once were, Nerve is different because of these features that are unique to the financial circumstances of the creative economy: Users have the ability to give and receive instant payments with other Nerve account users (like Venmo or PayPal, but without fees), to keep track of social media and streaming stats in one dashboard, and receive royalty payments. Also, the “collab” feature allows users to group together team members for full financial transparency about a creative project.

“Most music creators just starting out might have five different sources of income, and then it kind of explodes from there,” says Waupsh. “Not necessarily that the income streams are super big, but they’re coming from various places and the income is very erratic. So we realized we needed to make it easy to map it all in one place.”

Nerve launched at the end of 2021, and because it’s so new, there are still several features that the company is rolling out. The latest is opening the app up to more kinds of creators—visual artists, actors, podcasters, crafters, writers, etc.—because they discovered that musicians weren’t the only ones using it. There’s now a feature that allows users to select varying creative identities.

The very fact that banking sucks, we kind of thrive on that, because we know it does and we try to make it as easy as possible.

John Waupsh

“We’re starting with the creator economy because they’re obviously a huge growing segment, and they deserve economic dignity,” says Waupsh. “But I think everyone’s going to demand this soon.”

They also found that bigger accounts are interested in tax reporting upgrades that will take care of their taxes at the end of the year. This feature is expected to be released soon for a $200 add-on. Additionally, Nerve is only available right now in the US and parts of Canada, but they are working to bring it internationally, streamlining the payout process across currencies.

Overall Waupsh says he would like to see Nerve serve the creative economy from top to bottom, making it quick and easy for artists to get paid by entities of all sizes.

“We exist to help make banking easy so that you can focus on your craft, so that you can easily get back to what it is that you need to do,” says Waupsh. “The very fact that banking sucks, we kind of thrive on that, because we know it does and we try to make it as easy as possible.”